Secure Your Assurance With Reliable Home Insurance Coverage

Why Home Insurance Coverage Is Necessary

The significance of home insurance exists in its ability to supply economic defense and satisfaction to homeowners in the face of unexpected events. Home insurance coverage offers as a safeguard, offering coverage for problems to the physical framework of the residence, individual items, and responsibility for crashes that might take place on the residential property. In the occasion of all-natural catastrophes such as earthquakes, fires, or floods, having a comprehensive home insurance plan can assist house owners recuperate and rebuild without dealing with considerable financial burdens.

Additionally, home insurance policy is commonly needed by mortgage lending institutions to secure their investment in the residential property. Lenders wish to ensure that their economic rate of interests are protected in case of any type of damage to the home. By having a home insurance coverage in place, home owners can fulfill this requirement and safeguard their investment in the property.

Kinds of Protection Available

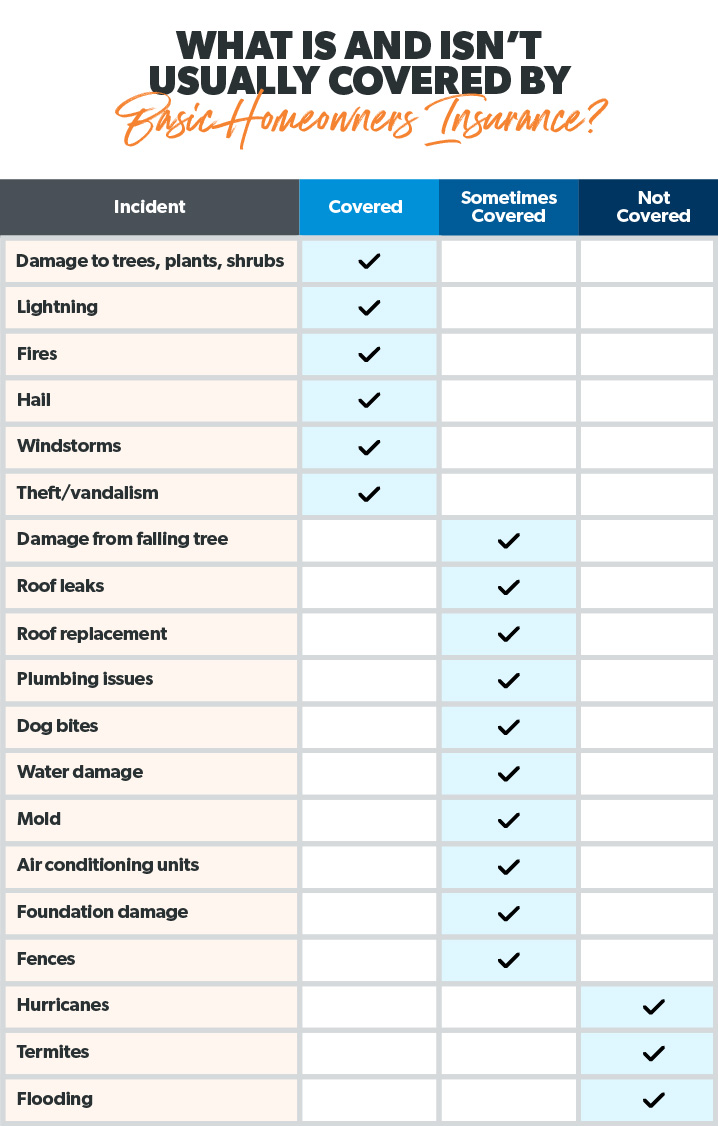

Provided the importance of home insurance coverage in securing home owners from unexpected financial losses, it is important to understand the different types of protection readily available to customize a plan that matches specific demands and circumstances. There are several essential sorts of protection used by a lot of home insurance policy plans. The very first is house protection, which secures the framework of the home itself from dangers such as fire, criminal damage, and natural catastrophes (San Diego Home Insurance). Personal effects protection, on the other hand, safeguards possessions within the home, consisting of furniture, electronics, and garments. Responsibility protection is necessary for securing property owners from legal and clinical expenditures if a person is harmed on their residential property. Additional living expenses insurance coverage can help cover costs if the home comes to be uninhabitable as a result of a protected loss. It is essential for homeowners to carefully assess and understand the various kinds of insurance coverage readily available to ensure they have appropriate protection for their specific demands.

Elements That Influence Premiums

Aspects influencing home read this insurance costs can vary based on a variety of factors to consider certain to private situations. Older homes or homes with outdated electric, plumbing, or heating systems might position higher risks for insurance policy business, leading to higher costs.

Furthermore, the coverage restrictions and deductibles selected by the policyholder can influence the costs amount. Selecting higher protection limits or reduced deductibles typically causes higher costs. The kind of building and construction materials made use of in the home, such as wood versus block, can likewise influence premiums as particular materials might be much more at risk to damage.

Exactly How to Select the Right Policy

Picking the suitable home insurance coverage plan involves cautious factor to consider of various essential facets to ensure extensive protection tailored to individual needs and scenarios. To begin, analyze the value of your home and its components properly. Next off, think about the different types of coverage readily available, such as home insurance coverage, individual residential property insurance coverage, liability protection, and additional living costs protection.

In addition, evaluating the insurance provider's track record, monetary security, client solution, and declares process is crucial. Search for insurance companies with a background of trusted solution and punctual insurance claims settlement. Lastly, compare quotes from multiple insurers to discover a balance between cost and coverage. By meticulously reviewing these aspects, you can choose a home insurance plan that supplies the necessary protection and satisfaction.

Advantages of Reliable Home Insurance Coverage

Reputable home insurance supplies a complacency and defense for house owners against monetary losses and unforeseen events. Among the key advantages of reputable home insurance is the assurance that your residential property will be covered in the occasion of damage or damage created by natural catastrophes such as storms, floodings, or fires. This coverage can assist homeowners avoid birthing the complete expense of fixings or rebuilding, offering tranquility of mind and financial stability during difficult times.

In addition, reputable home insurance policy policies often consist of liability security, which can secure home owners from clinical and lawful expenditures in the instance of crashes on their residential or commercial property. This coverage prolongs beyond the physical structure of the home to safeguard against claims and insurance claims that may emerge from injuries received by visitors.

Moreover, having trustworthy home insurance policy can additionally add to a sense of overall well-being, knowing that your most considerable investment is secured versus different risks. By paying regular premiums, homeowners can mitigate the potential financial burden of unexpected events, allowing them to concentrate on appreciating their homes without constant worry about what could take place.

Conclusion

To conclude, safeguarding a trusted home insurance coverage is essential for protecting your property and items from unforeseen events. By recognizing the sorts of insurance coverage offered, factors that affect premiums, and exactly how to choose the right plan, you can ensure your peace of mind. Relying on in a trustworthy home insurance coverage provider will offer you the benefits of economic protection and protection for your most important asset.

Navigating the world of home insurance can be complicated, with various protection alternatives, policy aspects, and factors to consider to weigh. Comprehending why home insurance policy is necessary, the kinds of protection offered, and just how to choose the ideal plan can be pivotal in ensuring your most substantial financial investment remains safe.Offered the significance of home insurance policy in protecting property owners from unanticipated financial losses, it is important to recognize the numerous types of coverage offered to customize a plan that fits specific demands and circumstances. San Diego Home Insurance. There are a number of crucial kinds of insurance coverage provided by a lot of home insurance policy policies.Selecting the suitable home insurance coverage plan involves mindful factor to consider of numerous crucial facets to ensure comprehensive insurance coverage tailored to individual requirements and scenarios